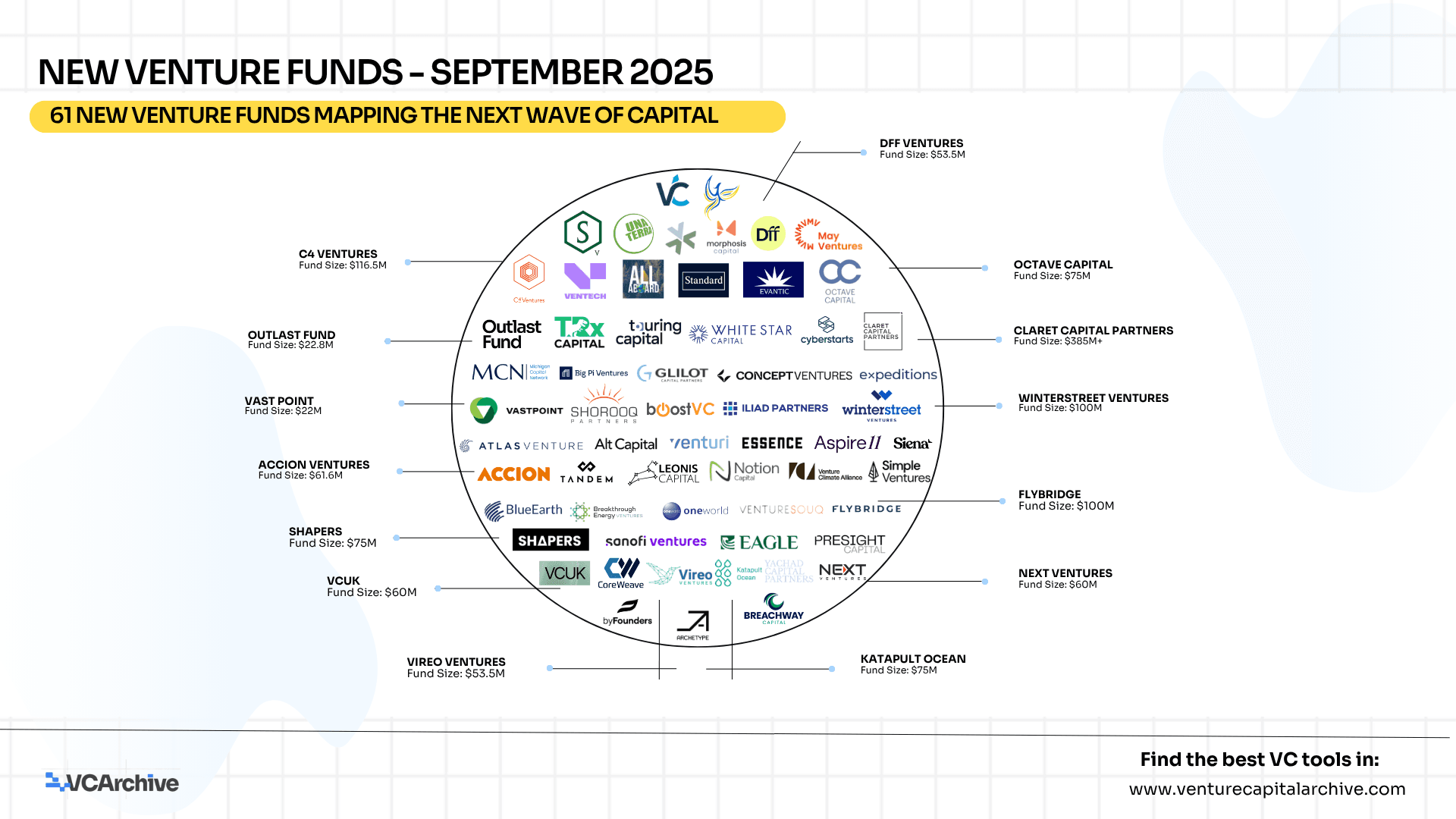

New Venture Funds - September 2025

Rather than simply adding dry numbers to the ecosystem, these funds bring sharp strategies, institutional capital, and operator-first approaches that will define how the next generation of startups is funded.

5 Key Themes Defining September’s New Funds

1. Biotech & Healthcare Innovation

Life sciences continue to draw heavyweight attention. Atlas Venture (United States) doubled down on Series A and growth-stage biotech, while T.Rx Capital in Boston launched with a focus on platform therapeutics and biotech ventures at seed. In Europe, Venture Investors Health Fund in Madison and Winter Street Ventures in Boston are channeling capital into digital health and predictive analytics, reinforcing healthcare as one of the most defensible and impact-rich categories.

2. Climate Tech & Sustainability

The month saw a surge in climate-focused capital pools. Venture Climate Alliance, backed by a global consortium managing $60B, is fueling decarbonization at scale, while Blue Earth Ventures (Switzerland) and VoLo Earth Ventures (United States) are targeting clean energy, carbon management, and industrial decarbonization. Regionally, Octave Capital (Singapore) and Katapult Ocean (Norway) are deploying funds into ocean tech and sustainable energy across Asia and global waters.

3. AI & Frontier Technologies

From early to growth stages, AI remains an unshakable theme. Leonis Capital in San Francisco is backing AI-first technical founders at pre-seed, while Touring Capital and CoreWeave Ventures are scaling AI-powered B2B software and infrastructure globally. On the defense and cybersecurity side, Scout Ventures (New York) and Cyberstarts (Israel) are channeling capital into dual-use and security-first AI solutions.

4. Regional Ecosystem Builders

Several funds are designed to unlock undercapitalized ecosystems. Outlast Fund (Latvia) and byFounders VC (Copenhagen) are doubling down on Nordic and Baltic founders. Ukraine Phoenix Tech Fund is investing directly into Ukraine’s reconstruction tech stack, while Vastpoint (Poland) is bridging Central European founders with U.S. markets. In MENA, Iliad Partners (Dubai) and Shorooq Partners (Abu Dhabi) are scaling early-stage digital and fintech startups across frontier economies.

5. Consumer Growth & Cross-Border Brands

Consumer remains a cornerstone of growth investing. Venturi Partners (Singapore) is doubling down on Southeast Asian consumer brands, while Tandem Ventures (Mexico City) is powering Latin America’s fintech and consumer products. In North America, All Aboard Fund (New York) and GG Ventures (Carolinas) are seeding technology-driven consumer plays, with Standard Capital (San Francisco) writing larger growth-stage checks into real assets and financial services.

Why This Matters

- For founders: These new funds expand the diversity of available capital, whether you’re building a biotech platform in Boston, a climate-tech venture in Berlin, or a fintech startup in Riyadh.

- For LPs and co-investors: The rise of climate-focused consortiums, AI-native micro-funds, and regional specialist vehicles shows where long-term conviction is concentrating.

- For policymakers: The presence of funds like Ukraine Phoenix Tech Fund and pension-backed Aspire11 (Czech Republic) shows how venture is increasingly tied to national strategies, resilience, and institutional capital flows.

September’s launches underscore one truth: venture capital is fragmenting into sharper, more thematic strategies. Whether through deep specialization in AI, sustainability, or healthcare or via regional bets on emerging ecosystems, these funds are positioning themselves as active builders of the next decade’s defining companies.

👉 Dive into the full dataset of all 61 funds, complete with thesis, cheque size, sector focus, and key people - now available on VCArchive.

New Venture Funds - September 2025

Rows per page